Last Updated on September 11, 2023 by Surender Kumar

Are you planning for your future healthcare needs and trying to figure out how best to secure Medicare coverage? With so many possibilities available, it can be confusing deciding which plan fits your individual lifestyle and budget.

That’s why it’s important to understand how different plans work, the benefits they offer, and look into different paths that may be more financially sound.

In this blog post we will walk you through the process of understanding what Medicare Advantage Plans are, tips for comparing them and direct you towards finding a plan that is right for your personal health needs and financial situation.

Table of Contents

Listing the Various Medicare Plans and Their Benefits

We’ve all heard the wise old saying, “Health is wealth.” It’s a mantra that holds true, and now more than ever, it’s essential to prioritize your well-being. One way to do that is by selecting the right Medicare plan that can transform your health into your greatest asset. So, let’s dive straight in and explore the Medicare Advantage plans for 2024.

Original Medicare (Medicare Part A & B).

First up, we have Original Medicare (Medicare Part A & B).

This plan is often referred to as the ‘OG’ of Medicare plans, and for good reason. It’s a government program that combines Part A (Hospital Insurance) and Part B (Medical Insurance), offering a comprehensive coverage package. With Original Medicare, you have the freedom to choose your healthcare providers, giving you the flexibility you desire.

Who is Original Medicare ideal for?

It’s perfect for individuals who value a broad range of provider options. Whether you have a preferred doctor or hospital in mind, Original Medicare allows you to select the ones that accept Medicare, ensuring that you receive the care you need.

One of the key advantages of Original Medicare is its extensive coverage of health services. From hospital stays to doctor visits and preventive care, this plan has you covered. Plus, with the ability to choose your own doctors and hospitals, you can have peace of mind knowing that you have control over your healthcare decisions.

By opting for Original Medicare, you’re making a proactive choice to prioritize your health and well-being. It’s an investment in yourself that can lead to a healthier and happier future. So, take the first step towards securing your health as your greatest asset by considering Original Medicare as your preferred plan.

Medicare Advantage Plan (Part C)

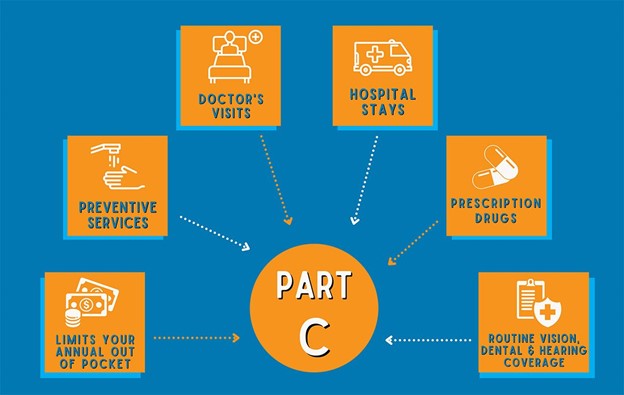

Part C, also known as the Medicare Advantage Plan, can be likened to a sumptuous all-you-can-eat buffet of health coverage. It offers an enticing “all-in-one” alternative to Original Medicare and is provided by private companies that have obtained approval from Medicare.

So, who is the Medicare Advantage Plan designed for? Well, it caters to individuals who desire additional coverage and don’t mind having a slightly limited network of healthcare providers.

One of the remarkable advantages of this plan is that it encompasses all the services covered by Original Medicare, and it often goes above and beyond by including extra benefits such as vision and dental care. But wait, there’s more! Some plans even provide gym memberships, making it a true win-win situation for individuals looking to stay fit and healthy.

Prescription Drug Plan (Part D)

Part D is like the cherry on top of your Medicare sundae, offering comprehensive prescription drug coverage that goes beyond what Original Medicare and Medicare Supplements typically provide. It’s designed for individuals who require regular prescriptions and are looking to save substantial amounts on their medication expenses.

One of the key advantages of Part D is that it helps cover the cost of prescription drugs, including both generic and brand-name medications. This coverage can be particularly beneficial for individuals with chronic conditions or those who rely on multiple medications to manage their health. By enrolling in Part D, you can have peace of mind knowing that your prescription drug costs will be significantly reduced, making your healthcare more affordable.

Another significant advantage of Part D is its ability to protect against high unexpected drug costs in the future. With the rising prices of medications, it’s crucial to have a reliable and affordable means of accessing the prescription drugs you need. Part D plans often include a coverage gap or “donut hole,” which provides additional financial protection once your total drug costs reach a certain threshold. This can help prevent excessive out-of-pocket expenses and ensure that you have continued access to the medications you rely on.

By considering Part D as part of your Medicare coverage, you can enjoy comprehensive prescription drug benefits, significant cost savings, and protection against unexpected drug costs. It’s a valuable component of your healthcare coverage that can provide you with the peace of mind and financial security you deserve.

Medicare Supplement Insurance (Medigap)

As the name suggests, Medigap fills in the ‘gaps’ by covering some of the healthcare costs that Original Medicare doesn’t cover. This includes copayments, coinsurance, and deductibles, ensuring you have comprehensive coverage.

Who’s it for? Medigap is ideal for those who want peace of mind knowing that almost all health costs will be covered, giving you the freedom to focus on your well-being without financial worries.

Advantages: One of the key advantages of Medigap is that it helps limit out-of-pocket costs, saving you from unexpected expenses. Additionally, it provides coverage that travels with you anywhere in the U.S., so you can have peace of mind no matter where you go. With Medigap, you can be confident that your healthcare needs are taken care of.

Remember, the best plan for you depends on your personal health needs and budget. So, don’t rush into a decision. Take your time, do your homework, and if needed, consult with a trusted healthcare professional. After all, your health is your wealth, right?

Tips for Comparing Medicare Plans

Now that you know the four main types of Medicare plans, let’s look at how to compare them. Here are some helpful tips:

- Take a close look at all your options and consider which plan best fits your health needs and budget.

- Research the different coverage details and make sure to read the fine print.

- Compare quality ratings for each plan before making a decision.

- Consider costs beyond just the premiums – look at deductibles, co-payments, and other out-of-pocket expenses that you may have to pay in the future.

- Call a Medicare advocate or use online resources to compare plans and get the help you need to make an informed decision.

- Don’t forget to check whether your preferred providers are in-network for a given plan.

- And, last but not least – if it sounds too good to be true, it probably is!

Conclusion

Navigating the world of Medicare can be daunting. But if you take the time to research and compare plans, you’ll be able to find one that fits your budget and health needs. With the right plan in place, you can feel confident knowing that you have comprehensive coverage for all of your healthcare expenses.

So, don’t wait – start researching today and make sure you’re prepared for your future!

I am a passionate blogger having 10 years of experience in blogging and digital marketing. I started List Absolute in 2018 to give my passion a live platform. I have also a good hand in writing unique and quality content. Here I contribute in my free time. Thanks for reading. Let me know if I can help you get your work done in a timely manner.